Maintaining Your Tax Exempt Status

After you initially qualify for tax exempt status as a 501(c)(3) charitable nonprofit organization, you’ll need to submit an annual Form 990 to maintain your status. Groups who can qualify for tax exempt status and must file a Form 990 include private foundations, educational institutions, hospitals, and charities.

Because your nonprofit does not have to pay federal income tax, the form is the government’s way of keeping up with your organization and ensuring that your stated purpose of business continues to fall within exemption qualification.

Benefits of Tax Exempt Status

Qualifying for tax exempt status helps your organization save money. If you had to pay federal or state income tax, all donations you received would be taxable. Plus, your donors would not be able to receive a tax deduction for their contributions. With your exemption, you can assure all donations contribute to your initiatives, enhance your donors’ enthusiasm for giving, and make private foundations more likely to contribute.

Take advantage of your tax exemption benefits, and be sure to file your annual Form 990 on time to avoid losing your status.

Deadlines

The Form 990 deadline is always the fifteenth day of the fifth month after your fiscal year ends. For example, if your fiscal year ends in December, then your deadline is May 15. If your fiscal year ends in June, then your deadline is November 15.

The penalty for missing the submission deadline is $20 per day until the form is received for up to $10,000 or 5% of your gross receipts,whichever penalty is lower for the organization. If your organization fails to submit your Form 990 for three consecutive years, then you lose your tax exempt status, are subject to federal income tax, and must file another form 1023 to requalify for tax exempt status.

Fear not, if you are in the midst of filing your 990, but don’t foresee the possibility of meeting the deadline—you can file a Form 8688, and the IRS will grant an extension to push the deadline six months from the original.

Stay ahead of the deadline by marking it on your calendar, and make sure that you’re completing the type of Form 990 that your nonprofit qualifies for.

Types of Form 990

All 501(c)(3) qualified organizations that submit a yearly Form 990 will include an annual statement of your nonprofit’s financial information and summary of your organization’s mission. The key items the IRS is looking for in all types of Form 990s are the continuation of your approved exemption purpose and proof of your annual gross receipts.

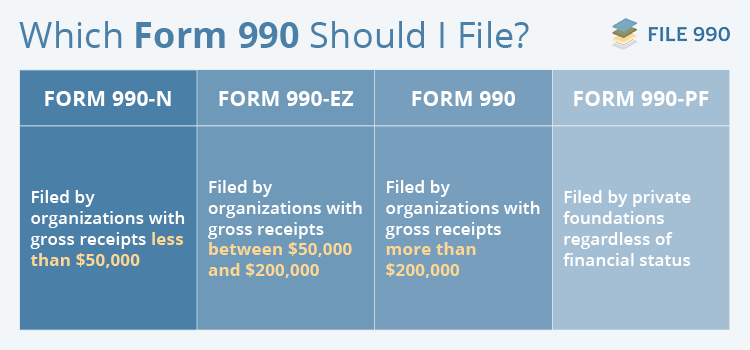

The larger the organization, the more total assets, and the more complex the Form 990. There are different types of the tax form that vary in complexity based on the annual gross receipts of your nonprofit, including Form 990-N, Form 990-EZ, and Form 990.

Double check your annual revenue prior to starting your annual form to ensure you’re completing the correct 990 form for your gross receipts bracket.

Form 990-N

Form 990-N is the simplest nonprofit tax form for smaller organizations with less than $50,000 in gross receipts. This form is also referred to as the 990 e-postcard because it can be filed online and is only nine pages long.

Even as the most basic form, there is still a list of information required that may take time to gather, such as your:

- Employer Identification Number

- Taxpayer Identification Number

- Year of filing

- Nonprofit name and address

- Leadership names and address

- Website

- Proof of gross annual receipts below $50,000

Consider submitting a Form 990-N if you are eligible to streamline your tax exemption process and reduce the risk of any overcomplications that can eat up your valuable time.

Form 990-EZ

Mid-size nonprofits with annual gross receipts between $50,000 and $200,000 are eligible to complete the Form 990-EZ, which is also filed electronically. Although this form is slightly more in-depth than the 990-N, it is not as involved as the full 990.

If you’re transitioning from a Form 990-N to 990-EZ, File 990’s guide can help you walk through the additional requirements in a Form 990-EZ. The guide explains how to complete the new sections such as:

- Revenue, expenses, and net assets

- Balance sheets

- Description of your yearly initiatives’ achievements

- Record of all leadership members and key employees

- List of all grants received

Double check your annual revenue prior to starting your forms so you don’t have to redo any of the forms in the circumstance that your gross receipts have changed substantially.

Form 990

Larger nonprofits with annual gross receipts over $200,000 or total assets over $500,000 must submit the most involved and complete Form 990. Your organization can choose to submit this form electronically or by mail.

This form requires all information requested in Form 990-N and Form 990-EZ and additional information detailing how your organization uses funding.

Using Form 990

The yearly process of filing your Form 990 can help you understand important information that is crucial to your organization’s success. If you aren’t looking closely at your revenue streams, donation base, or total assets, filling out Form 990 might help you reassess areas for improvement. Using expense management tools can alleviate some stress by helping you keep track of your assets throughout the year.

Large organizations will need to include the financial information for all of their chapters. If you don’t have a dedicated nonprofit accounting team, this can be a large undertaking, and you may not know where to look to find the required information for the form.

Adding e-filer software to your tech stack can streamline the process by reminding you and all your chapters when it’s time to start filling out your form. The software can then compile your entire organization’s information once received. This can save you the hassle of scrambling to remind your chapters and save them the confusion of sorting through unfamiliar information.

Once you submit your Form 990, you should receive verification of receipt, and then all you have to do is enjoy your tax exempt status!